Below is a partial transcript from our latest webcast, “ASC 606: Understanding Contract Modifications and Variable Consideration,”. It covers the types of contract modifications in ASC 606 and how you can account for them. If you would like to view the full recording, click here.

Below is a partial transcript from our latest webcast, “ASC 606: Understanding Contract Modifications and Variable Consideration,”. It covers the types of contract modifications in ASC 606 and how you can account for them. If you would like to view the full recording, click here.

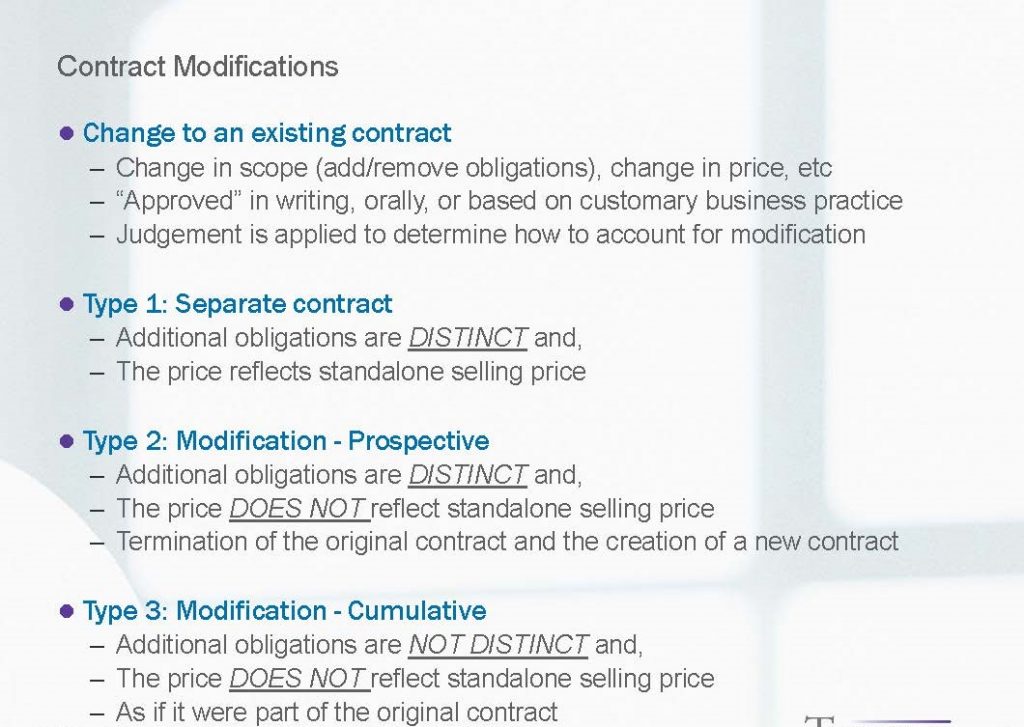

“Judgement is required on how you account for modifications. While there is guidance, the application of the guidance is somewhat conceptual with two important concepts to be considered – is the new obligation distinct from the other obligation and is it sold at its standalone selling price? Those are the two things that you have to figure out with this- if you add a product to it, was that product sold before, is it distinct from those other products, or is it some additional quantities/services that are pretty much the same to that you have already sold, and are you selling it at it’s standalone selling price. Based on the answer to these questions, you have 3 types of outcomes on how you account for them:

Type 1: Separate contract

The first one is the easiest. If the obligations are DISTINCT – it wasn’t something you sold before, and you sell them at your stand-alone selling price than essentially, it’s a new contract. The old contract continues to recognize revenue as it was going, and the additions are essentially treated as a new contract from a revenue recognition stand point and may be an amendment to the existing contract or may be actually the same contract that you just write in and promise some additional goods. But from an accounting standpoint and even from a Revenue Lens standpoint, it’s going to be considered a new separate document and accounted for an allocated revenue separately without consideration of the allocation of the original contract.

Type 2: Modification- Prospective Method

This is when the additional obligations are DISTINCT. Like type 1, these are new products, but you sell them at a price that DOES NOT reflect the standalone selling price. So, you sell it at a price different than the standalone selling price. At this point, it is considered part of the original contract, and at a high level you treat it as if the original contract was terminated as of the date the obligation became an obligation, so the modification date and you create a new contract.

This will make more sense when I show you an example- essentially what happens is all the revenue that has been recognized up to the date of modifications stays as is and then any unrecognized performance obligations plus the change (and so now you have got the amount that is remaining that has not been recognized), gets reallocated. It gets pulled together as the single transaction price and gets reallocated based on the standalone selling price. So, you have got this terminated contract that sort of stops, all that recognized revenue stays as is and the new leftover amounts in the original plus the change is reallocated and recognized going forward as you satisfy those performance obligations.

Type 3: Modification – Cumulative Method

This is the most complex and has a lot going on. It’s called the cumulative approach and essentially, this is when it’s NOT DISTINCT – something you have already included in the original contract and it’s NOT at it’s standalone selling price. And what happens here is that you treat as if it was part of the original contract. So what you do there is that you reallocate the total amended/updated transaction price and reallocate it based on the standalone selling prices and there’s this cumulative effect of change in the current period or whatever the period of the effective date of modification and you have an adjustment essentially in that period- to say we are into the contract six months, what would that six months have been using the updated values and true up your revenue through that six months in the current period to that. So, you could have a positive or negative adjustment in the current period. There is a true up in the period of modification so that the cumulative revenue through the modification date is what it should be with the post-modification transaction price. Going forward you continue to recognize revenue as normal.”

For a better understanding, this webcast covers an example of both the prospective and cumulative approach. View the recording here.

If you’re interested in learning more about the upcoming CPE-eligible webcasts on ASC 606, then be sure to register here. To learn more about Tensoft Revenue Lens and how it can help you with your revenue recognition needs, click here.