Paul Revere is most famously known for “The Midnight Ride” and his repeated warnings, “The redcoats are coming!” As it relates to the idea of improper revenue recognition, we opine his prescient chants would proclaim “The red ink is coming!” at the dawn of the restatement announcement.

Paul Revere is most famously known for “The Midnight Ride” and his repeated warnings, “The redcoats are coming!” As it relates to the idea of improper revenue recognition, we opine his prescient chants would proclaim “The red ink is coming!” at the dawn of the restatement announcement.

In a previous blog, we recently profiled Osiris Therapeutics (NASDAQ: OSIR), a public pharmaceutical company which announced revenue restatements, the subsequent destruction of shareholder value and how an auditable, systems approach could have helped mitigate these risks. Since publishing a few months ago, additional disclosures revealed an auditor resignation, class action lawsuits, and CXO turnover. Factoring in the costly internal reviews, revising SEC reporting, board and management distractions, onboarding a new auditor, crisis management investments, and other issue-reactive activities related to the restatements, it is crystal clear the hard (and soft) costs associated to reconciling the errors may well exceed the actual revenue impact from the misstatement. If market capitalization is considered a short term, performance metric, over $400 million is lost since the initial disclosure.

During the past quarter another prescription drug company, Valeant Pharmaceuticals (NYSE: VRX), also restated revenues. Valeant’s reported issues and political stigma appear to be much broader, not only limited to the revenue recognition spectrum. Yet similar to Osiris, accelerated periodic timing misstatements were recorded. In this case, the errors were for drug sales via distribution on a sell-in basis (e.g. recorded when sold to the pharmacy network) rather than the correct sell-through basis (e.g. recorded when the pharmacy network actually dispensed the prescriptions to patients). The revenue implications at Valeant were more pronounced to the tune of $58 million for fiscal year 2014. And the associated fallout greater by several magnitudes…

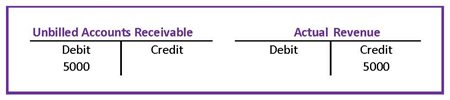

Reviewing our historical American figure, Paul Revere is also credited in partaking in the Boston Tea Party, a sign of opposition to what was viewed at the time as improper controls. Interestingly enough, another famous ‘T’ manage debits and credits serving as the basis for following GAAP accounting standards – the ubiquitous T Account.

Although it may be commonplace to use T Accounts (along with spreadsheets) to track revenue transactions it is certainly no party. Dumping manual, error prone processes by adopting a revenue specific system to manage the revenue transaction business rules and enhancing administrative controls to facilitate reliable entries with compliance tools may well provision greater outcomes than the inherent risks of the ‘do nothing’ alternative. While instituting and adhering to systemic controls require perseverance, lacking efficient controls may prove future “red ink is (forth)coming”.

For more information about Tensoft’s products and services, please contact us. If you’d like to comment on this article, I encourage you to tweet, post to LinkedIn, or blog about it!