Tensoft Multi-National Financial Consolidation

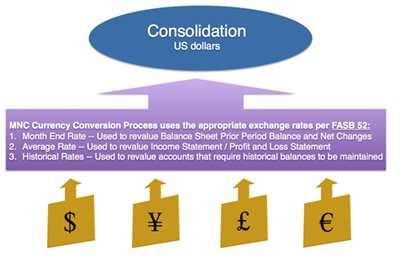

Tensoft’s MNC product allows you to bring together financial data from disparate sources to create a global view of all financial information across your entire enterprise, no matter the currency or geographic location. The graphic to the right illustrates how Tensoft MNC works.

At the bottom are subsidiary companies and their various currencies. Tensoft MNC takes the information from these subsidiary companies, translates it, and then moves it into a consolidated Dynamics GP Company. Local currencies are brought across, as well as your reporting currency.

Multi-National Requirements

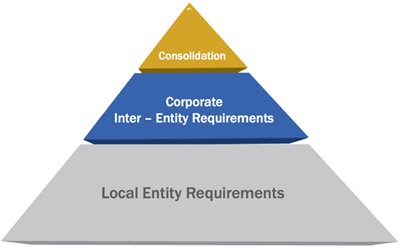

A good understanding of your multi-national requirements can help you design and achieve the best results from your financial architecture, for your month-end reporting, as well as for your day-to-day transactions. The pyramid to the left illustrates this, and show where Tensoft MNC provides the most benefit.

Tensoft Multi-National Consolidation (MNC) allows you to bring together financial data from disparate sources to create a global view of all financial information across your entire enterprise . . . no matter the currency or geographic location. So easy, anyone can run it, freeing you to analyze the results!

Improve Efficiency with Seamless Integration

Tensoft’s Multi-National Consolidation was built to run with Microsoft Dynamics GP. Fully .NET and web- based, MNC can run inside of Microsoft Dynamics GP, or Microsoft Dynamics GP Business Portal

Calculate CTA Impact

Quickly calculates the CTA impact by entity. Consolidates local entities by reading the local functional currency net change amounts, or period balances by account. The net change balances reference the Microsoft Dynamics GP exchange rate tables for revaluation purposes. Calculates and maintains foreign exchange impact by statutory entity by account for better reporting and foreign exchange analysis.

Historical Rate Maintenance

Historical rates can be assigned to any Microsoft Dynamics GP account on an entity by entity basis. This feature allows you to have one view to ensure that the proper consolidation methods are being applied across your organization. Accounts requiring historical rates are identified during the consolidation process allowing users to enter exchange rates down to the transaction level.

Case Study: Chordiant

“Chordiant has international entities, and works in a number of different currencies world-wide, so having a financial consolidations software system that allows us to handle many different currencies is very valuable. It has been beneficial for handling the acquired companies, and has added value by streamlining our processes.” — Narayan Prabhu, Corporate Controller, Chordiant Systems