Continuing the series on the ‘Impact of ASC 606’, here’s another area that a re-seller or a distributor business should be aware of with potential impacts to their business model: “How to Determine Estimated Transaction Price.” [The following is a partial transcription from the webcast, “Implementing ASC 606: Potential Changes to Distributor and Reseller Based Revenue Recognition” hosted by Tensoft and presented by Jeffrey Werner. To view the recorded webcast in full, click here.]

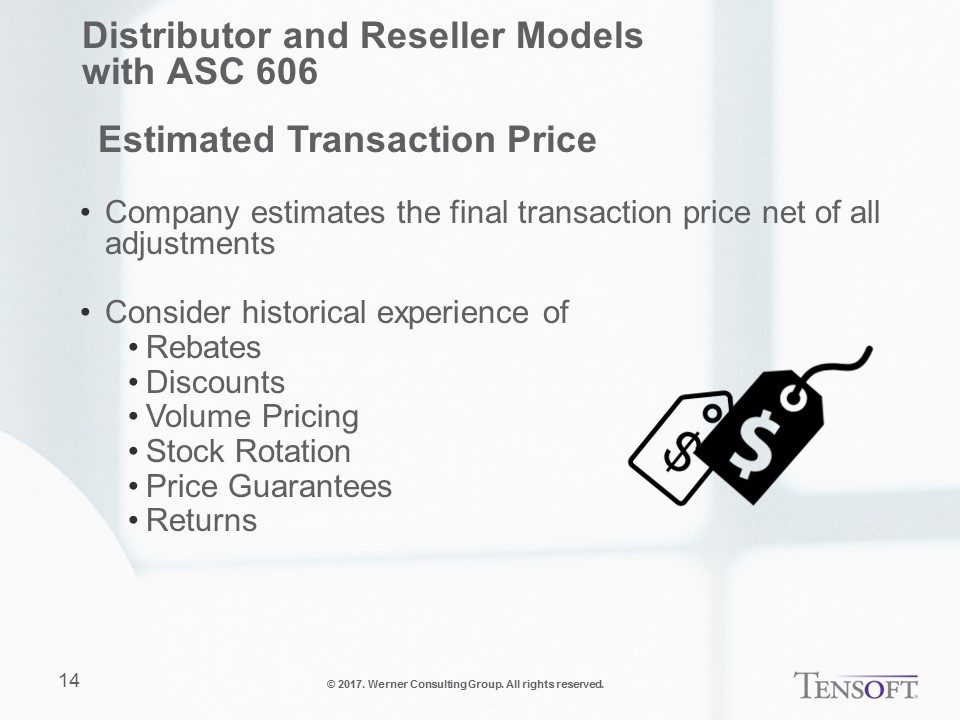

“Our second topic in the on-demand webcast today is how to determine the estimated transaction price under ASC 606, the new revenue recognition standard. The company is required to make an estimate of what the final transaction price is going to be, net of all the adjustments, and you would consider your business practice of how you either from business practice or contractually provide rebates, discounts, volume pricing, stock rotation, price guarantees, returns – anything that would adjust the price of the products and the final fee that you’re getting from your customer, the reseller or the distributor. Remember that there’s a contractual relationship between the company and the reseller or the distributor, not the end user. So, that’s who you consider to be your customer and that’s the determination of the value and the point in time that you recognize revenue.

We’re required to estimate what the transaction price is going to be, using the best available information. And, then in each period, in each accounting period – if we’re a public company, that would be each quarter – we’d review our estimates. If there’s any reason to change those estimates, we’d then adjust revenue up or down at the end of that period, such that when the final amount is received from the customer it should equal the adjusted revenue. Or revenue should be adjusted at that point in time when the final amount of the revenue is known.

We said that we want to make sure that we don’t recognize more revenue than is likely to be subject to a significant reversal. Some of the factors that would lead you to believe that there might be a significant reversal would be that the adjustments are highly susceptible to outside factors. So, you would adjust if competitors made price adjustments – obviously, those competitive adjustments from competitors would be outside of your control. If there were other factors that would contribute to a discount or a rebate that were outside your control, that would be a factor that you’d want to think about when you made your estimate and whether you determined whether there’s a likelihood of a significant reversal.”

For more insights, view the full recording here.

Tensoft hosts free training webcasts on a regular basis to share the recent developments in the software industry. If you are interested to know more about the upcoming webcasts, click here to sign up.