Tensoft hosted another complimentary one hour CPE-eligible webinar on the New Revenue Recognition Standard. This webinar entitled “How to Be Ready for the New Revenue Recognition Standard” featured revenue recognition expert, Jeffrey Werner. Jeffrey covered both the background information of Revenue Recognition and some detail concerning the most recent developments of The New Revenue Standard. We have compiled the responses to the polling questions asked during the webinar, and think they might be of interest to you! Scroll down and see how attendees responded to beginning to deal with the New Revenue Recognition Standard.

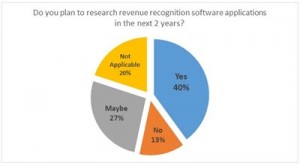

Most of the attendees plan on researching revenue recognition software in the next year. As more changes occur in regards to revenue recognition, it will become more and more beneficial for companies to have software applications to track their revenue recognition.

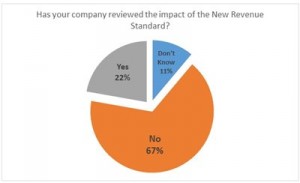

Interestingly enough most companies have not yet looked into the impact of the New Revenue Standard in regards to their industry and or company. Seeing as how the New Revenue Standard will go into immediate effect in 2017 for public companies & 2018 for privately held companies, it is important that companies know if the New Revenue Standard will impact them or not.

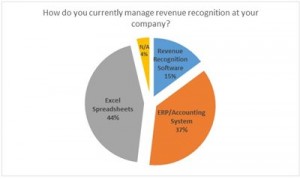

As seen in the pie chart above, most companies currently use excel spreadsheets and or ERP/Accounting Systems to manage their revenue recognition. It might be of interest to note that if you are using spreadsheets to track your revenue recognition you should be VERY Cautious! To learn more about how the use of excel spreadsheets can be dangerous for managing revenue recognition, check out our past blog post: “Using Excel for Revenue Recognition Tracking?”

As you can see, most attendees said that the New Revenue Standard would more than likely have an impact on their company, in which we would have to AGREE. The New Revenue Standard will more than likely have an impact on your company.

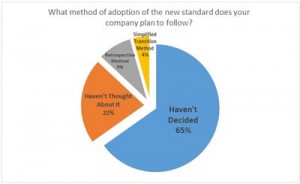

Most attendees were unsure of how they will adopt the new standard in their company. For those of you who are still unsure these quick facts from Jeffrey’s blog post “What is the New Revenue Recognition Standard and How Does it Affect Me?” might help you in deciding between the Retrospective Method and the Simplified Transition Method:

– Retrospective Method: When companies issue their 2017 financial statements they may need to present 2015 & 2016 also under the new standard

– Simplified Transition Method: Requires companies to re-state their financial statements at the beginning of the year of adoption and then to dual-track revenue throughout the first year of presentation under the new standard

To find out more about current and past webcasts, visit Tensoft’s Event’s Page. To see how Tensoft might be able to help you with your Revenue Recognition problems check out Tensoft’s Revenue Recognition Software or contact us directly!